Chapter 1: Innovative continuous trading success algorithm

1.1 The New Trading Paradigm

The dynamics of financial markets present new challenges and opportunities every day. Successful trading requires fast and accurate data analysis. The Consecutive Trading Success Algorithm is an innovative trading tool developed to meet these market demands.

Characteristic Changes in Modern Financial Markets:

- Increase in Algorithmic Trading

- Accounts for approximately 70-80% of all trades

- Over 90% of institutional investors utilize algorithms

- Maximization of trading speed (microsecond level)

- Sharp Increase in Market Volatility

- Immediate reaction to global events

- Increased influence of news and social media

- Emergence of new price patterns

- Limitations of Traditional Analysis Methods

- Decreased efficiency of existing technical analysis

- Exposure of manual trading limitations

- Increased importance of real-time response capability

Distinctive Features of the Consecutive Trading Success Algorithm:

- Real-time Data Processing and Analysis

- Processing thousands of data points per second

- Real-time pattern recognition and analysis

- Immediate signal generation and updates

- Multi-Timeframe Analysis

- Simultaneous analysis of 13+ timeframes

- Understanding correlations between timeframes

- Identifying optimal trading timing

- Evolution of AI-based System

- Application of self-learning models

- Adaptive strategies for market conditions

- Continuous performance optimization

1.2 Origins of the Consecutive Trading Success Algorithm

The Consecutive Trading Success Algorithm originated from efforts to overcome the limitations of traditional trading methods. Since its first release in 2019, it has undergone continuous improvements and developments to reach the current Version 8.0 "PrimeX".

Key Development Milestones:

1. Initial Research Phase (2018)

- Analysis of Existing Trading Systems

- Research on major failure causes

- Identification of successful strategy commonalities

- Study of market inefficiencies

- AI Application Feasibility Study

- Testing various AI models

- Verification of real-time processing capability

- Scalability assessment

- Prototype Development

- Basic algorithm design

- Initial backtesting

- Performance optimization

2. Beta Testing Period (Early 2019)

- Professional Trader Group Selection

- Inclusion of various trading styles

- Testing across multiple asset classes

- Real-time feedback collection

- Real Environment Testing

- Verification in various market conditions

- Risk management system check

- Performance stability evaluation

- System Improvement and Optimization

- User feedback incorporation

- Algorithm performance enhancement

- Interface improvement

3. Official Launch Preparation (Mid-2019)

- System Stabilization

- Large-scale stress testing

- Error handling system reinforcement

- Backup system establishment

- User Environment Optimization

- Intuitive interface design

- Real-time support system setup

- Educational material creation

- Final Performance Verification

- Comprehensive backtesting

- Real-time trading tests

- Final risk management system check

1.3 Structure and Utilization of This Manual

This manual is structured to enable systematic learning from theoretical foundations to practical application of the Consecutive Trading Success Algorithm.

Learning Stage Approach:

- Basic Level

- Understanding algorithm fundamentals

- Learning key technical indicators

- Basic chart pattern analysis

- Intermediate Level

- Mastering multi-timeframe analysis techniques

- Learning AI signal interpretation

- Establishing risk management strategies

- Advanced Level

- Developing advanced trading strategies

- Portfolio optimization

- Building automation systems

Chapter Utilization Guide:

- Chapters 1-2: Theoretical foundation learning

- Chapters 3-4: Practical application methods

- Chapters 5-6: Advanced strategy development

- Chapter 7: System utilization and support

1.4 Changes in Trading Environment and Response

The trading environment continues to evolve with technological advancements and changing market dynamics. Our algorithm adapts to these changes through continuous updates and improvements.

Key Environmental Changes:

- Increased market connectivity and speed

- Growing influence of algorithmic trading

- Higher market volatility

- Complex data integration requirements

1.5 Integration of AI Technology and Financial Markets

AI technology has become an integral part of modern financial markets, bringing new

Chapter 2: Basic Concepts of Consecutive Trading Success Algorithm

2.1 Core Philosophy of the Algorithm

The core of the Consecutive Trading Success Algorithm lies in its deep analysis of candle and chart patterns across various timeframes, applying our unique evaluation indicator algorithm during periods showing the highest success rates.

Detailed Explanation of Core Principles:

1. Data-Based Objective Analysis

- Real-time Market Data Collection

- Price data

- Volume data

- Market sentiment indicators

- Multidimensional Data Analysis

- Time series analysis

- Pattern recognition

- Correlation analysis

- Objective Evaluation System

- Performance metrics measurement

- Risk assessment

- Reliability verification

2. Multi-Timeframe Integrated Analysis

- Timeframe-Specific Characteristics Analysis

- Volatility patterns

- Volume characteristics

- Price movement patterns

- Inter-Timeframe Interaction Analysis

- Higher timeframe influence

- Lower timeframe reaction

- Timeframe coherence

- Optimal Timeframe Selection

- Win rate analysis

- Risk assessment

- Profitability verification

3. AI-Based Pattern Recognition

- Deep Learning Model Application

- Pattern recognition through CNN

- Time series analysis through RNN

- Strategy optimization through reinforcement learning

- Real-time Learning and Adaptation

- Learning new patterns

- Market change response

- Automatic performance optimization

- Pattern Reliability Assessment

- Historical success rate analysis

- Current market suitability evaluation

- Risk level measurement

4. Risk Management Optimization

- Position Sizing System

- Account size-based adjustment

- Volatility-based adjustment

- Risk limit setting

- Stop Loss Strategy

- Dynamic stop loss levels

- Market volatility reflection

- Trailing stops

- Profit Realization Strategy

- Staged profit taking

- Dynamic target adjustment

- Partial closing strategy

2.2 Importance of Multi-Timeframe Analysis

Multi-timeframe analysis plays a crucial role in understanding overall market flow and capturing optimal trading opportunities.

Detailed Analysis of Supported Timeframes:

1. Short-term Timeframes (1min-7min)

- 1-Minute Analysis

- Immediate price movement detection

- Short-term momentum measurement

- High-frequency trading opportunity capture

- 3-Minute Analysis

- Short-term trend confirmation

- Price reversal signal detection

- Volatility pattern analysis

- 5-Minute Analysis

- Key support/resistance level confirmation

- Short-term chart pattern formation

- Volume profile analysis

- 7-Minute Analysis

- Special timeframe pattern analysis

- Market sentiment change detection

- Medium-term turning point prediction

2. Medium-term Timeframes (10min-1hour)

- 10-Minute Analysis

- Trend direction confirmation

- Key turning point identification

- Momentum strength measurement

- 20-Minute Analysis

- Medium-term pattern formation confirmation

- Trend strength evaluation

- Key price level analysis

- 30-Minute Analysis

- Market structure analysis

- Major turning point prediction

- Volume pattern confirmation

- 1-Hour Analysis

- Intraday trend identification

- Major support/resistance setting

- Market psychology analysis

3. Long-term Timeframes (2hour-1month)

- 2-Hour/4-Hour Analysis

- Medium-long term trend confirmation

- Major price level setting

- Market cycle analysis

- Daily Analysis

- Overall market direction identification

- Long-term support/resistance setting

- Major event impact analysis

- Weekly/Monthly Analysis

- Macro market flow identification

- Long-term investment strategy development

- Major market cycle analysis

Benefits of Timeframe Integration:

- Multidimensional Market Understanding

- Higher timeframe trend direction confirmation

- Lower timeframe entry point optimization

- Understanding timeframe interactions

- Signal Reliability Enhancement

- Verification through multiple timeframe confirmation

- False signal filtering

- High-probability entry point identification

- Risk Management Enhancement

- Timeframe-specific volatility consideration

- Appropriate stop loss level setting

- Profit taking timing optimization

2.3 Integrated Approach to Technical Indicators

Technical indicators are integrated for comprehensive analysis to generate more accurate trading signals.

In-depth Analysis of Key Technical Indicators:

1. Bollinger Bands

- Basic Components

- 20-day moving average

- Upper/lower bands (2 standard deviations)

- Band width indicator

- Utilization Strategy

- Band width expansion/contraction analysis

- Price reversal signal detection

- Trend strength measurement

- Advanced Applications

- Multi-timeframe band analysis

- Dynamic standard deviation adjustment

- Band pattern recognition

2. MACD (Moving Average Convergence Divergence)

- Components

- 12/26-day EMA difference

- 9-day signal line

- MACD histogram

- Signal Types

- Golden/Death cross

- Divergence patterns

- Centerline crossover

- Advanced Usage

- Multi-timeframe coherence verification

- Momentum strength measurement

- Trend reversal point prediction

3. ATR (Average True Range)

- Basic Mechanism

- Actual price range measurement

- Volatility level quantification

- 14-day average calculation

- Practical Application

- Position sizing determination

- Stop loss level setting

- Target price setting

- Advanced Usage Methods

- Dynamic risk management

- Volatility-based strategy modification

- Market condition classification

4. Parabolic SAR (Stop And Reverse)

- Core Functions

- Trend reversal point identification

- Automatic stop loss point provision

- Trailing stop function

- Optimization Methods

- Acceleration factor adjustment

- Market condition-specific parameter setting

- Multi-timeframe application

- Practical Strategy

- Trend following system construction

- Risk management automation

- Exit point optimization

2.4 Pattern Recognition System

The pattern recognition system is a core component that identifies and analyzes various market patterns for optimal trading decisions.

Key Pattern Recognition Components:

1. Candlestick Patterns

- Single Candlestick Patterns

- Doji formations

- Hammer and Shooting Star

- Marubozu patterns

- Multiple Candlestick Patterns

- Engulfing patterns

- Morning/Evening Star

- Three White Soldiers/Black Crows

2. Chart Patterns

- Trend Continuation Patterns

- Triangles (Ascending/Descending)

- Rectangle formations

- Flag and Pennant patterns

- Reversal Patterns

- Head and Shoulders

- Double/Triple tops and bottoms

- Rounding patterns

2.5 Market Psychology Analysis

Understanding market psychology is crucial for predicting price movements and market behavior.

Psychological Analysis Components:

1. Sentiment Indicators

- Market Sentiment Metrics

- Fear and Greed Index analysis

- Volume-based sentiment indicators

- Options market sentiment

- Crowd Psychology Patterns

- Mass behavior analysis

- Trend following patterns

- Contrarian indicators

2. Behavioral Analysis

- Market Participant Behavior

- Institutional trading patterns

- Retail trader psychology

- Smart money movement tracking

- Decision Making Analysis

- Risk perception patterns

- FOMO and panic behavior

- Market cycle psychology

Chapter 3: Algorithm Structure and Functions

3.1 Multi-Timeframe Analysis System

The multi-timeframe analysis system comprehensively analyzes patterns occurring in each timeframe.

Detailed Explanation of Key Analysis Elements:

1. Candle Pattern Analysis

- Basic Patterns

- Doji

- Hammer/Hanging Man

- Engulfing patterns

- Complex Patterns

- Three Line Strike

- Morning/Evening Star

- Three Soldiers/Crows

- Reliability Assessment

- Volume confirmation

- Timeframe-specific success rate

- Pattern completeness

2. Chart Pattern Recognition

- Trend Patterns

- Triangle formations

- Channels

- Wedge formations

- Reversal Patterns

- Head and Shoulders

- Double Tops/Bottoms

- Rounding patterns

- Continuation Patterns

- Flags

- Pennants

- Rectangles

3. Timeframe-Specific Volatility Analysis

- Volatility Measurement

- ATR-based analysis

- Standard deviation calculation

- Volatility indicator utilization

- Timeframe Characteristics

- Market open/close times

- Session overlaps

- News release times

- Volatility Prediction

- Pattern-based prediction

- Time series analysis

- AI model utilization

4. Trend Strength Measurement

- Technical Indicator Usage

- ADX

- Trend Strength Index

- Momentum indicators

- Price Action Analysis

- Swing point measurement

- Trendline angle

- Moving average alignment

- Composite Analysis

- Multiple indicator integration

- Timeframe coherence

- AI-based evaluation

3.2 Integration of Core Technical Indicators

Each technical indicator has unique characteristics, and these are integrated to generate highly reliable trading signals.

Detailed Usage by Indicator:

1. Bollinger Bands

- Volatility Measurement

- Band Width Analysis

- Contraction/expansion pattern identification

- Volatility surge prediction

- Breakout possibility assessment

- Standard Deviation Utilization

- Volatility level quantification

- Risk management optimization

- Position sizing adjustment

- Band Width Analysis

- Trend Strength Analysis

- Band Slope Evaluation

- Trend direction confirmation

- Momentum strength measurement

- Reversal possibility assessment

- Price Position Analysis

- Relative strength measurement

- Overbought/oversold judgment

- Bounce/correction prediction

- Band Slope Evaluation

- Support/Resistance Level Identification

- Band Touch Analysis

- Reaction zone identification

- Breakout confirmation

- Re-entry point detection

- Dynamic Level Setting

- Volatility-based adjustment

- Market condition reflection

- Risk level setting

- Band Touch Analysis

2. MACD (Moving Average Convergence Divergence)

- Trend Direction Confirmation

- Signal Line Crossovers

- Entry point detection

- Exit point identification

- False signal filtering

- Centerline Analysis

- Major trend confirmation

- Strength change detection

- Reversal signal capture

- Signal Line Crossovers

- Momentum Analysis

- Histogram Pattern

- Momentum change detection

- Trend strength measurement

- Turning point prediction

- Divergence/Convergence Analysis

- Trend continuity evaluation

- Weakening signal detection

- Reversal possibility prediction

- Histogram Pattern

3. ATR (Average True Range)

- Volatility-Based Stop Loss

- Dynamic Stop Loss Setting

- Volatility level reflection

- Risk limit adjustment

- Trailing stop optimization

- Multiple ATR Application

- Risk level classification

- Staged exit planning

- Partial profit-taking strategy

- Dynamic Stop Loss Setting

- Position Sizing

- Risk-Based Adjustment

- Account size consideration

- Volatility level reflection

- Maximum loss limitation

- Leverage Optimization

- Safe margin setting

- Risk distribution

- Position weight adjustment

- Risk-Based Adjustment

4. Parabolic SAR

- Trend Reversal Point Detection

- Reversal Signal Analysis

- Price position confirmation

- Momentum change detection

- Probability-based evaluation

- Entry Timing Optimization

- Delay minimization

- False signal filtering

- Risk management enhancement

- Reversal Signal Analysis

- Trailing Stop Setting

- Dynamic Adjustment System

- Trend strength reflection

- Volatility consideration

- Profit protection enhancement

- Optimization Strategy

- Market condition-based adjustment

- Return maximization

- Risk minimization

- Dynamic Adjustment System

3.3 Advanced Position Entry and Exit

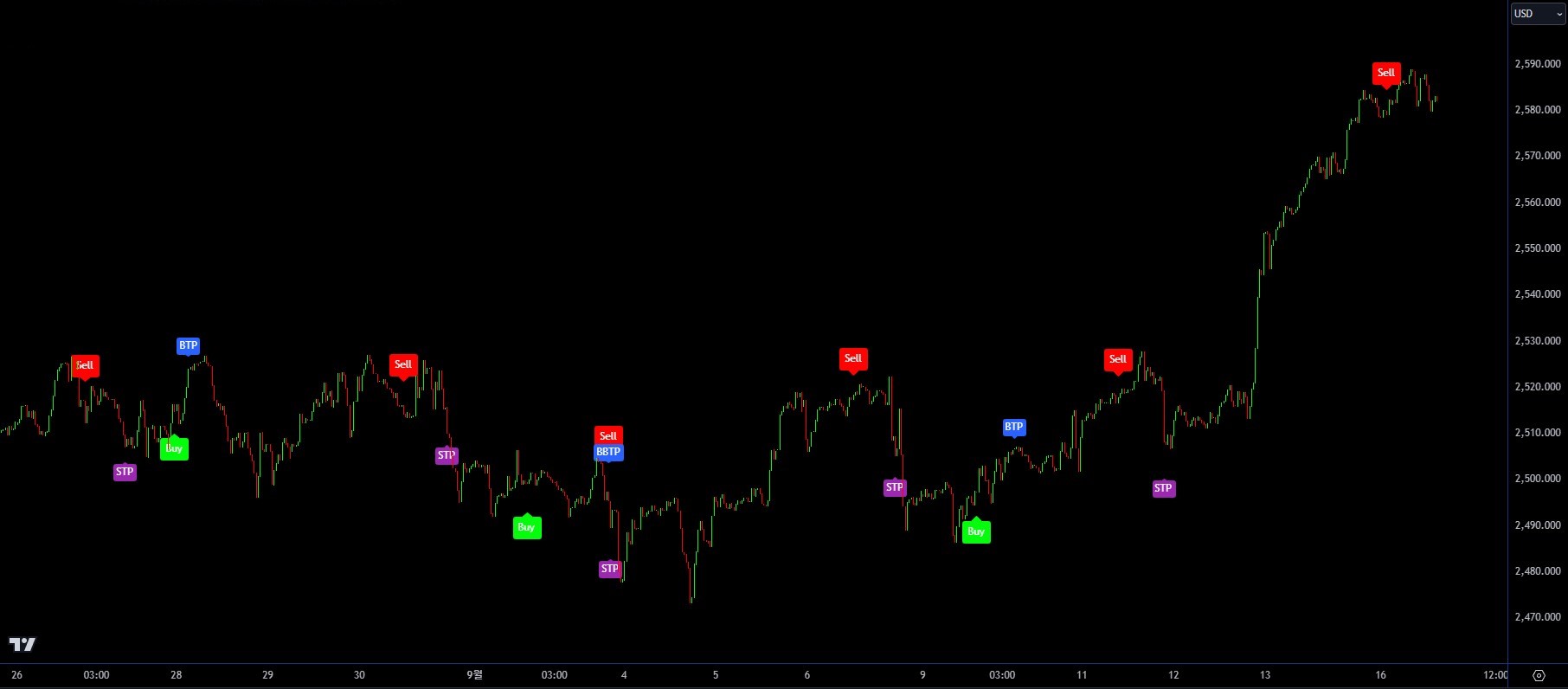

Position management is a core element of the algorithm. The BTP (Buy Take Profit) and STP (Sell Take Profit) systems determine optimal entry and exit points.

1. Advanced Entry Strategy

- Signal Integration Analysis

- Multiple Indicator Confirmation

- Cross-validation

- Reliability assessment

- Priority setting

- Timeframe Coherence Verification

- Higher timeframe trend

- Lower timeframe timing

- Conflicting signal resolution

- Multiple Indicator Confirmation

- Entry Condition Optimization

- Technical Conditions

- Key indicator alignment

- Pattern completeness

- Volume confirmation

- Market Situation Analysis

- Volatility level

- Liquidity state

- News impact evaluation

- Technical Conditions

2. Systematic Exit Strategy

- BTP (Buy Take Profit) System

- Profit Target Setting

- Technical target calculation

- Risk/reward ratio optimization

- Volatility-based adjustment

- Staged Profit Taking

- Partial exit planning

- Profit zone segmentation

- Remaining position management

- Dynamic Target Adjustment

- Market condition reflection

- Momentum strength consideration

- Trend continuity evaluation

- Profit Target Setting

- STP (Sell Take Profit) System

- Stop Loss Level Management

- Risk limit setting

- Volatility-based adjustment

- Technical level consideration

- Trailing Stop Optimization

- Profit protection enhancement

- Trend following efficiency

- Early exit prevention

- Market Condition Response

- High volatility handling

- Gap risk management

- News impact handling

- Stop Loss Level Management

3. Position Management Automation

- Risk Management System

- Position Size Control

- Account size consideration

- Risk percentage setting

- Leverage optimization

- Loss Limitation Mechanism

- Daily loss limits

- Weekly risk management

- Composite risk evaluation

- Position Size Control

- Profit Optimization System

- Win Rate Enhancement Strategy

- Entry condition strengthening

- False signal filtering

- Timing optimization

- Return Maximization

- Holding period optimization

- Partial exit strategy

- Trend following enhancement

- Win Rate Enhancement Strategy