Chapter 4: AI-Based Signal Generation System

4.1 Role and Importance of Generative AI

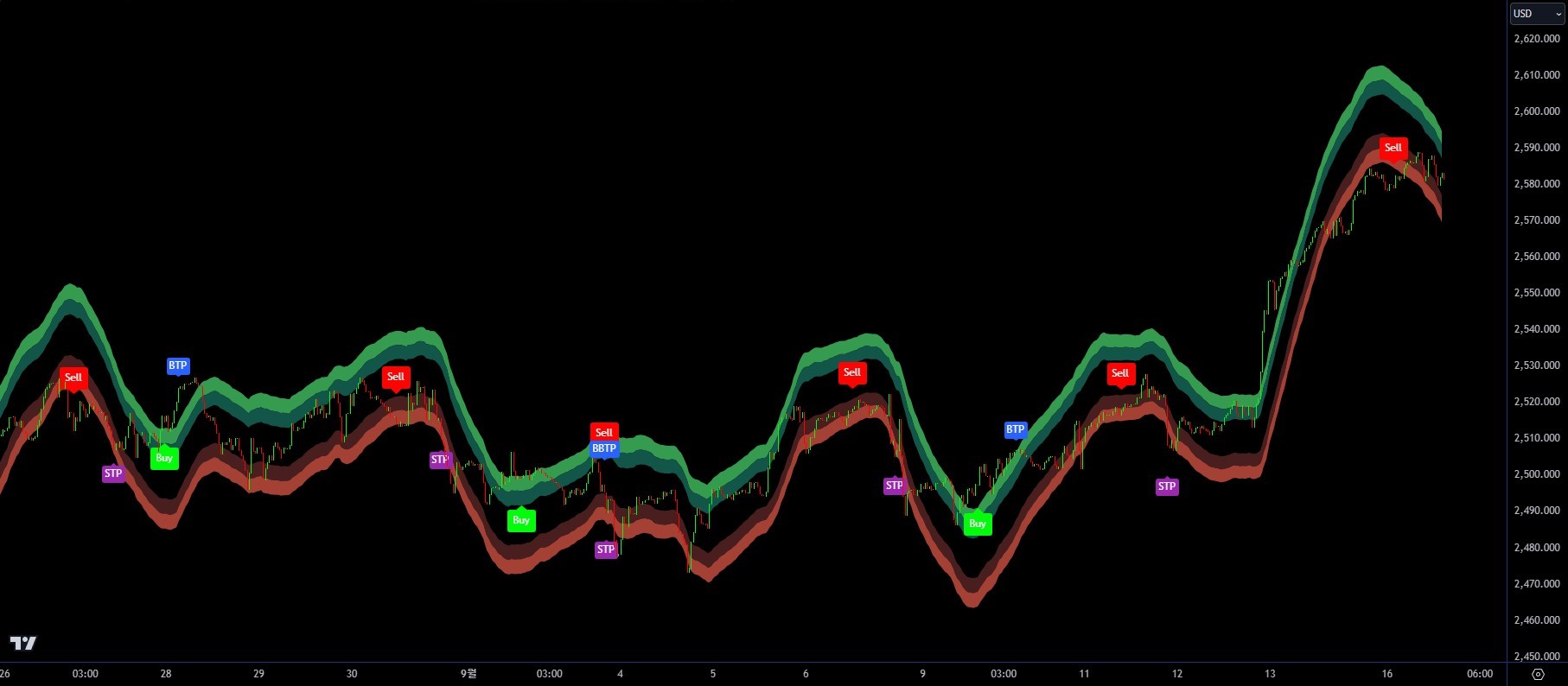

Generative AI analyzes market data and recognizes patterns to generate high-accuracy trading signals.

1. Core AI System Structure

- Deep Learning Model Configuration

- Neural Network Architecture

- CNN (Convolutional Neural Network)

- LSTM (Long Short-Term Memory)

- Transformer models

- Learning Data Management

- Data cleansing

- Automated labeling

- Quality verification

- Model Optimization

- Hyperparameter tuning

- Performance evaluation

- Real-time adaptation

- Neural Network Architecture

- Pattern Recognition System

- Chart Pattern Analysis

- Technical pattern recognition

- Price action analysis

- Volatility pattern identification

- Time Series Analysis

- Trend decomposition

- Cyclical analysis

- Anomaly detection

- Correlation Analysis

- Asset correlations

- Market sector analysis

- Global impact assessment

- Chart Pattern Analysis

2. Real-time Data Processing

- Data Collection and Preprocessing

- Market Data Collection

- Price data

- Volume information

- Market indicators

- Data Cleansing

- Noise removal

- Outlier handling

- Normalization

- Real-time Updates

- Latency minimization

- Data consistency maintenance

- Synchronization management

- Market Data Collection

4.2 Performance Optimization Based on Data

The system analyzes approximately 2,400 evaluation indicators to generate optimal trading signals.

1. Data Analysis Framework

- Indicator Classification System

- Technical Indicators

- Trend indicators

- Momentum indicators

- Volatility indicators

- Market Sentiment Indicators

- Supply/demand indicators

- Sentiment indices

- Investor psychology

- Composite Indicators

- Correlation indicators

- Sector analysis

- Systemic risk

- Technical Indicators

- Performance Evaluation System

- Profitability Analysis

- Absolute returns

- Risk-adjusted returns

- Sharpe ratio

- Risk Assessment

- Maximum drawdown

- Volatility analysis

- Recovery period

- Stability Verification

- Consistency evaluation

- Environmental adaptability

- Robustness testing

- Profitability Analysis

2. Optimization Process

- Parameter Optimization

- System Parameters

- Entry/exit conditions

- Risk management settings

- Timeframe weights

- AI Model Parameters

- Learning rate adjustment

- Layer configuration

- Activation functions

- Operational Parameters

- Execution speed

- Memory usage

- Processing capacity

- System Parameters

4.3 Risk Management System

1. Portfolio Level Risk Management

- Asset Allocation

- Diversification Strategy

- Asset class allocation

- Correlation consideration

- Rebalancing rules

- Risk Limit Setting

- Total exposure limitation

- Sector limits

- Leverage restrictions

- Dynamic Adjustment

- Market condition reflection

- Volatility-based adjustment

- Stress testing

- Diversification Strategy

Key Risk Management Features:

- Real-time risk monitoring and adjustment

- Automated position sizing based on risk parameters

- Dynamic stop-loss and take-profit management

- Multi-level risk assessment system

- Integrated risk reporting and alerts

Chapter 5: Practical Trading Guide

5.1 Chart Pattern Analysis Methodology

1. Basic Chart Patterns

- Trend Patterns

- Upward/Downward Trends

- Trend line drawing

- Trend strength evaluation

- Breakout points

- Channel Patterns

- Parallel channels

- Expansion/contraction channels

- Channel breakout strategies

- Wedge Formations

- Rising/falling wedges

- Formation process analysis

- Breakout signals

- Upward/Downward Trends

- Reversal Patterns

- Head and Shoulders

- Pattern components

- Target calculation

- Failed pattern recognition

- Double Tops/Bottoms

- Formation conditions

- Volume confirmation

- Confirmation signals

- Inverse V/V Patterns

- Sharp reversals

- Momentum analysis

- Entry timing

- Head and Shoulders

2. Advanced Pattern Analysis

- Complex Patterns

- Diamond Formations

- Component stages

- Volatility analysis

- Breakout direction prediction

- Triangle Convergence/Divergence

- Pattern type classification

- Volume changes

- Breakout strategies

- Rectangle Patterns

- Range setting

- Trading opportunity capture

- Breakout strategy

- Diamond Formations

5.2 Timeframe Selection and Trading Strategies

1. Timeframe Selection Criteria

- Volatility Analysis

- Intraday Volatility

- Time-specific patterns

- Volume profile

- Price reactions

- Weekly Volatility

- Day-specific characteristics

- Weekly patterns

- Monthly cycles

- Event Impact

- Regular economic indicators

- Corporate earnings releases

- Policy changes

- Intraday Volatility

2. Custom Strategy Development

- Trading Style Selection

- Scalping

- Short-term volatility utilization

- Rapid entry/exit

- Small profit targets

- Day Trading

- Intraday trend capture

- Multi-timeframe analysis

- Same-day closure principle

- Swing Trading

- Medium-term trend following

- Higher risk/reward

- Position holding

- Scalping

- Market Condition-Specific Strategies

- Trending Market Strategy

- Trend strength measurement

- Entry point optimization

- Profit realization stages

- Range-bound Market Strategy

- Range setting

- Repetitive pattern utilization

- Breakout preparation

- Volatile Market Strategy

- Enhanced risk management

- Position size adjustment

- Bi-directional trading

- Trending Market Strategy

5.3 Case Studies of Real Trading

1. Success Case Analysis

- 32 Consecutive Successful Trades Case

- Market Environment

- Overall market conditions

- Sector trends

- Volatility levels

- Entry Conditions

- Technical setup

- Timing selection

- Risk settings

- Management Process

- Position adjustment

- Profit realization

- Risk management

- Market Environment

- High-Return Trade Analysis

- Opportunity Identification

- Pattern recognition

- Timing selection

- Leverage utilization

- Position Management

- Incremental investment

- Partial exits

- Stop loss adjustment

- Final Results

- Profit analysis

- Risk assessment

- Improvement points

- Opportunity Identification

2. Failure Cases and Lessons

- Major Failure Patterns

- Signal Errors

- False signal identification

- Filtering methods

- Improvement measures

- Risk Management Failures

- Excessive positions

- Delayed stop losses

- Emotional responses

- System Errors

- Technical issues

- Connection failures

- Execution delays

- Signal Errors

Key Learning Points from Case Studies:

- Importance of systematic approach and discipline

- Risk management is crucial for consistent success

- Technical analysis must be combined with market context

- Emotional control in both winning and losing trades

- Continuous learning and adaptation to market changes

× ![]()